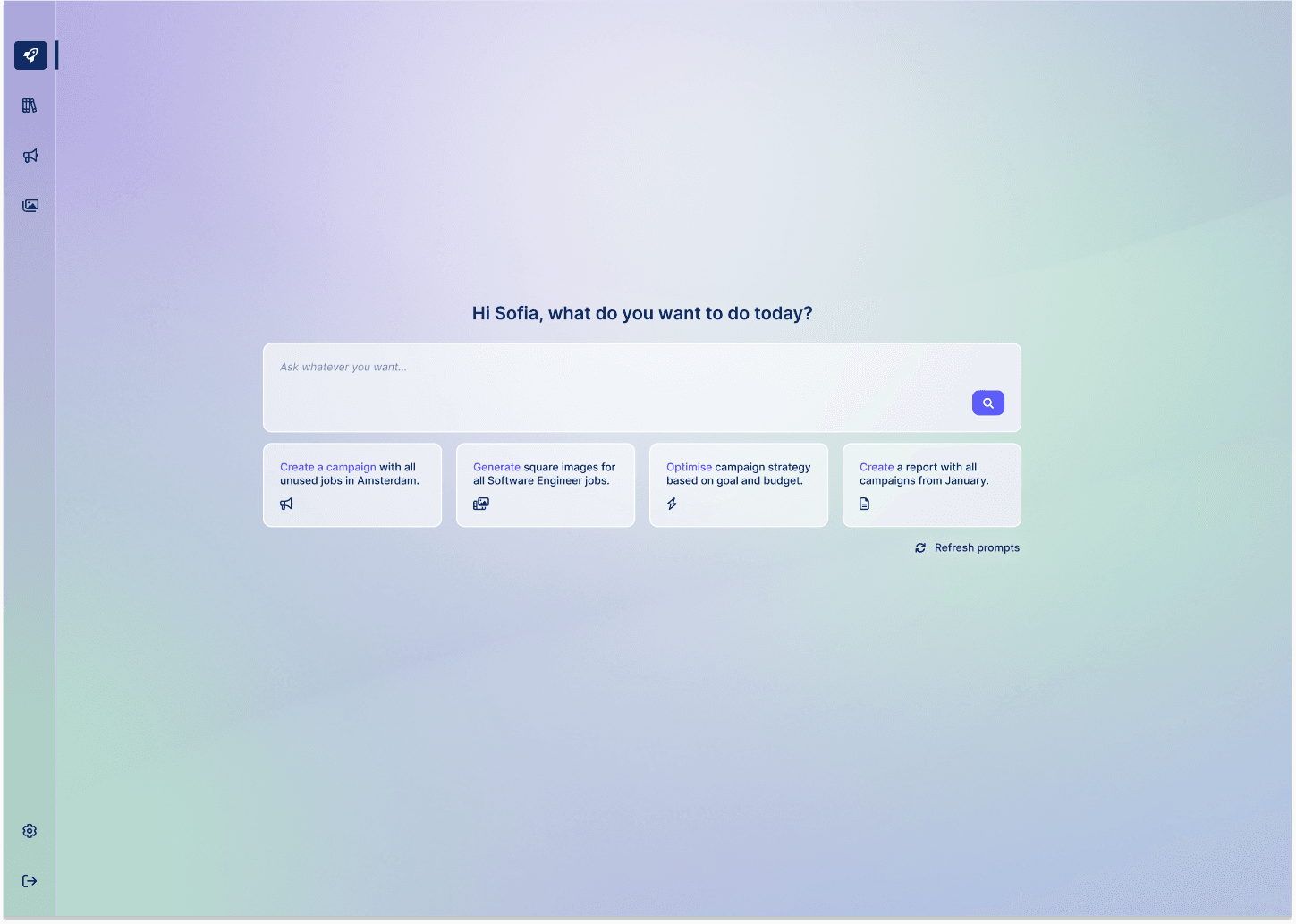

End-to-end design of KYC verification toolkit and admin-level configurations.

Payaut, now part of Nuvei, offers an automated, PSD2-compliant payment solution for online marketplaces. It enables seamless payments to platforms and sellers, allowing marketplaces to connect with preferred Payment Service Providers (PSPs). This flexibility leads to higher authorization rates, a wide range of payment methods, reduced downtimes, and competitive pricing. By managing payouts, split payments, and KYC processes, Payaut ensures PSD2 compliance, freeing businesses to focus on growth.

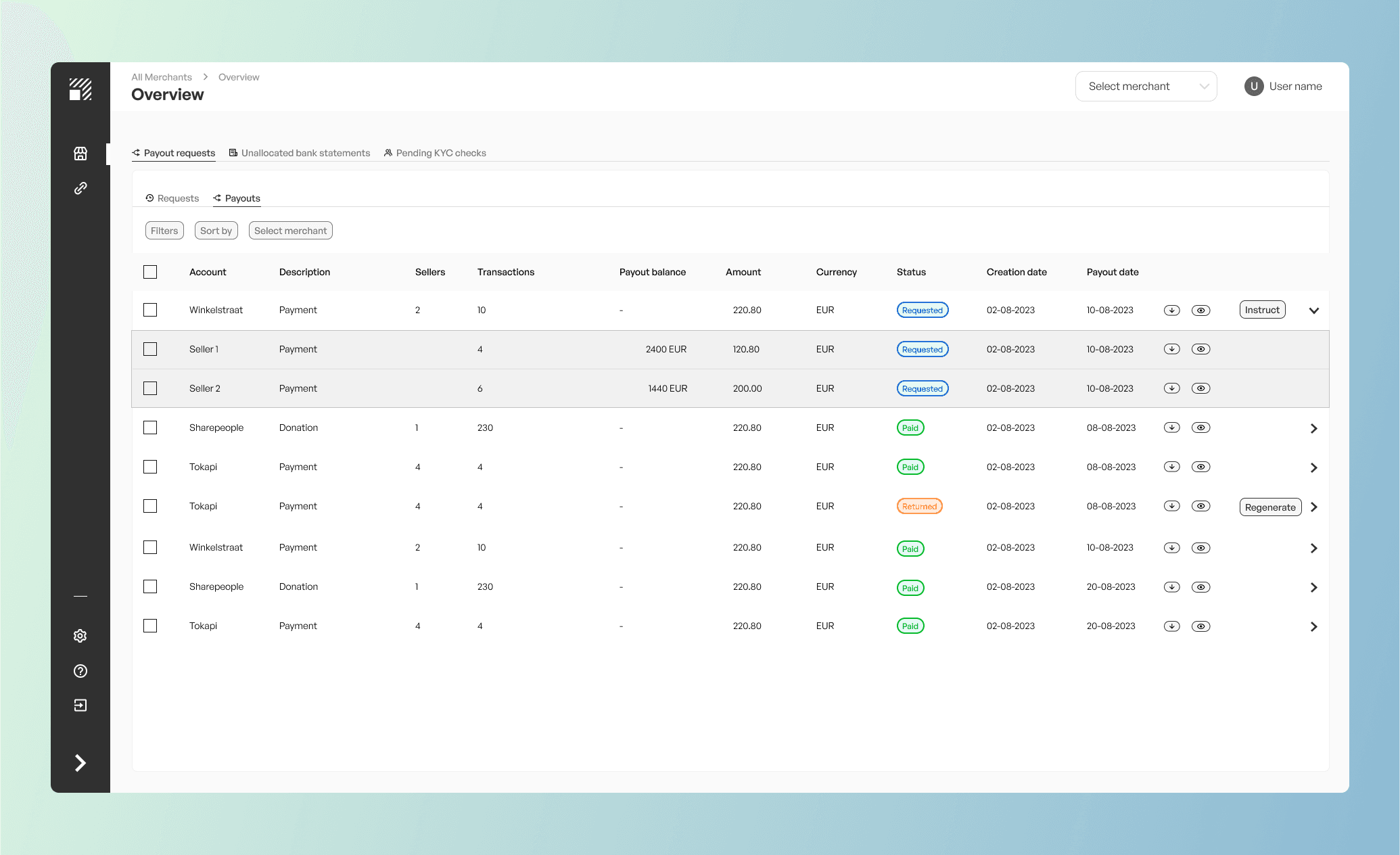

Designing the Operations Dashboard at Payaut

Crafting tools that empower internal teams to excel is one of the most rewarding aspects of design. That’s precisely what we achieved with the Payaut Operations Dashboard.

Built for our Operations team, this dashboard serves as a centralized hub for:

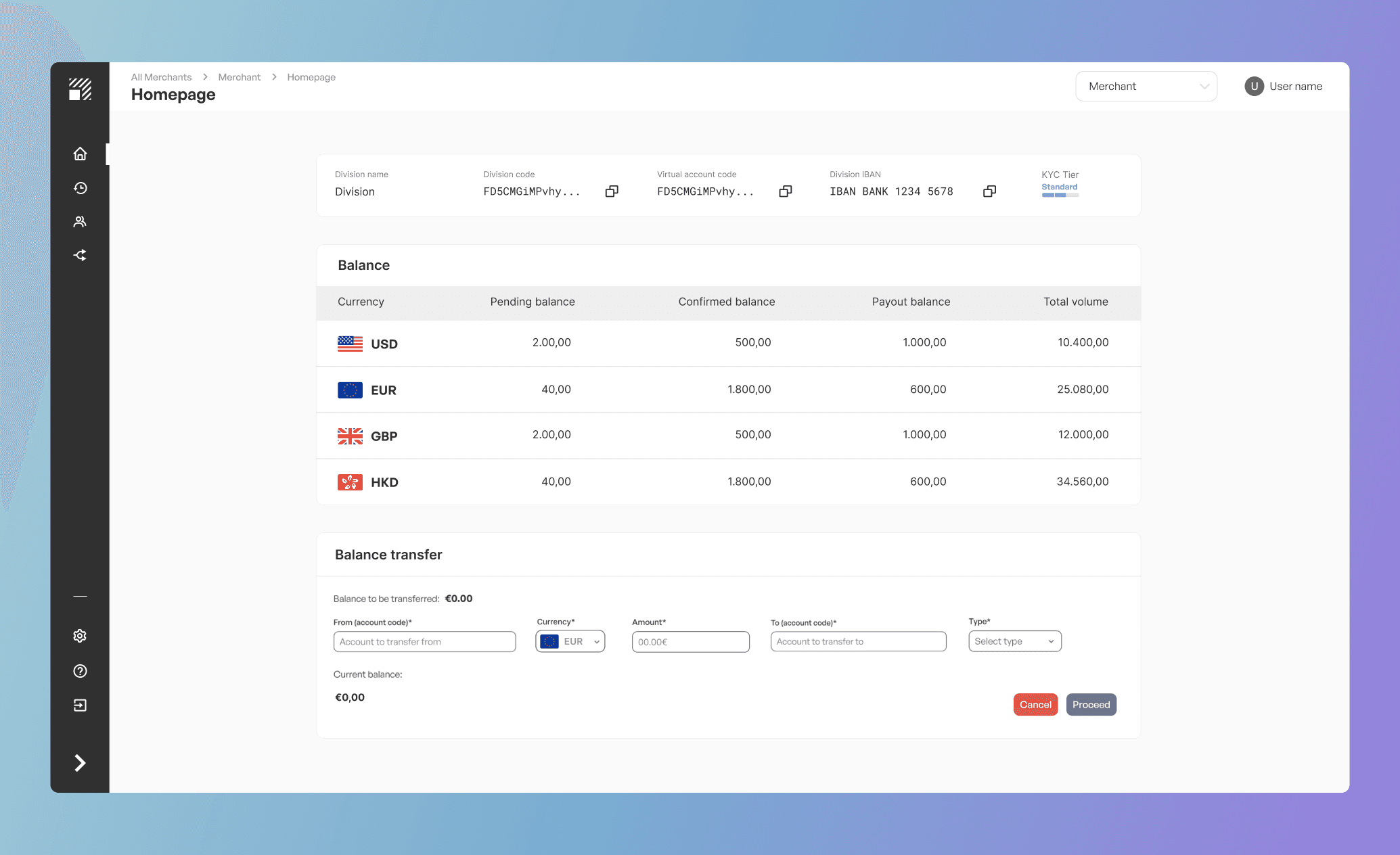

Overseeing and managing merchant balances.

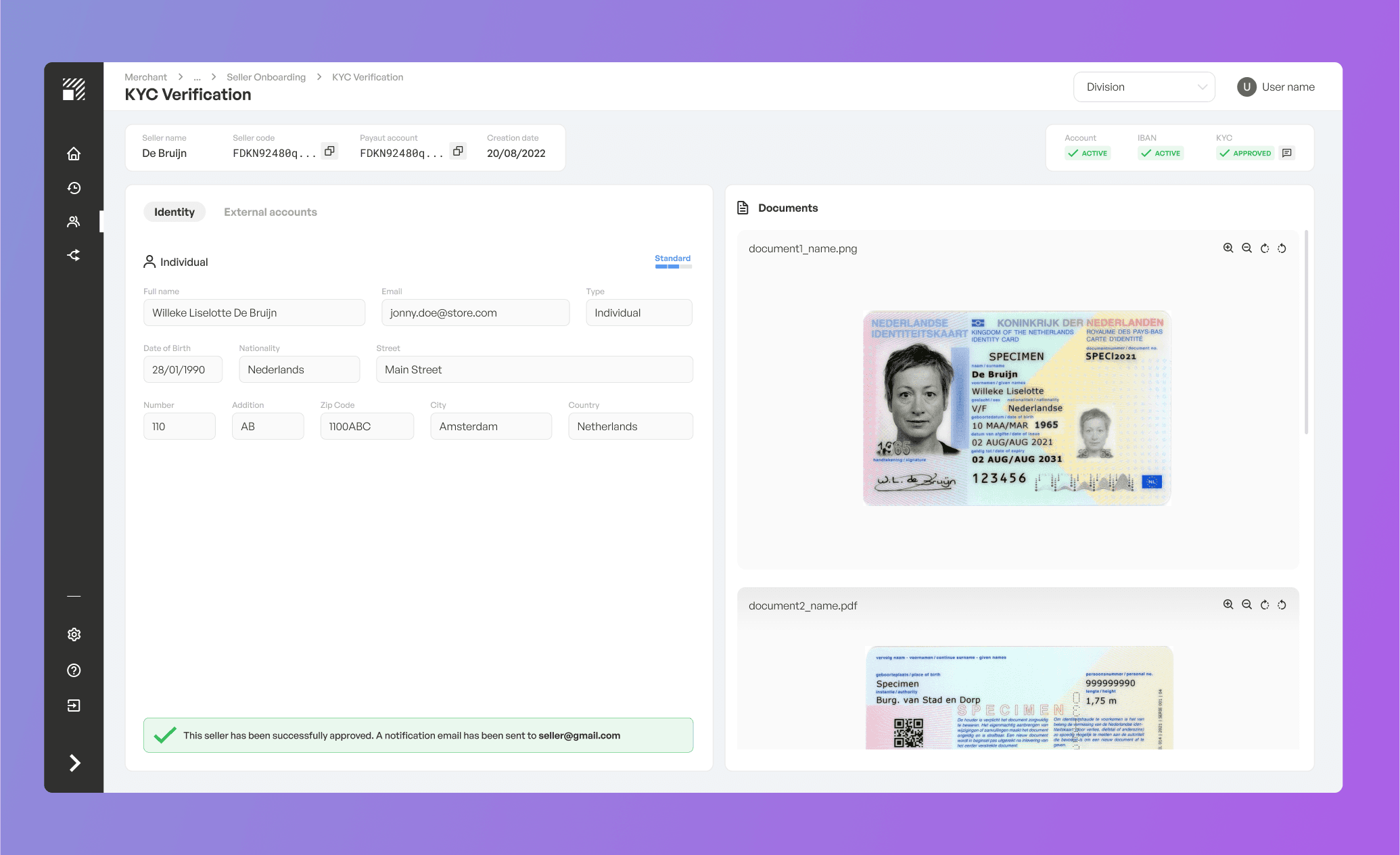

Onboarding new sellers with KYC and KYB verification tools.

Processing payments and generating reports.

Investigating, troubleshooting, and configuring settings at a division level.

This project was an end-to-end design challenge requiring collaboration across disciplines. I owned the design process partnering closely with frontend and backend developers. Through iterative feedback loops, we ensured every element of the dashboard was intuitive, functional, and tailored to user needs.

The result? A streamlined tool that enhances operational efficiency, simplifies complex workflows, and adheres to the highest usability standards. Seeing how this solution has transformed our team's day-to-day operations is incredibly fulfilling 🌟

Problem

Our Operations Team was navigating a patchwork of tools, relying on spreadsheets, manual processes, and even code diving to support our merchants. This fragmented approach was not only time-consuming but also prone to human error, posing significant risks when dealing with sensitive personal and financial data.

Some of the biggest challenges included:

Inconsistent data across tools: Time discrepancies in updates forced the team to cross-check figures manually with calculators in hand.

Manual KYC/KYB processes: Tasks like downloading and storing passport images, comparing them to submitted forms, and leaving validation notes required juggling multiple windows and tools.

Error-prone workflows: The lack of a unified interface for managing money transfers and compliance checks increased the risk of mistakes in a high-stakes environment.

It was clear: the team needed a reliable, user-friendly solution to manage sensitive operations effectively and securely.

My Approach

Understanding the Team’s Needs

To build the right solution, I collaborated closely with our Operations team. Together we observed their workflows, identified pain points, and took note of the tools they relied on and struggled with. Some of their challenges included:

Cross-checking information across disparate systems, often leading to data discrepancies.

Labor-intensive KYC validation involving manual downloads and checks.

A lack of streamlined communication channels for flagging and resolving issues.

Research & Learning

In addition to team interviews:

Conducted market research to explore compliance best practices and trends in financial dashboards.

Consulted with our Chief Risk & Compliance Officer to align the design with PSD2 regulations.

Analyzed internal processes to identify opportunities for automation and simplification.

Vision & Strategy

Building a product from scratch involves asking a lot of critical questions to ensure scalability, efficiency, and alignment with user needs. Some of the key questions that guided the vision and strategy for the dashboard included:

How should navigation be structured to optimize usability?

What tasks will the Operations team need to perform in the future as new features are added?

How many levels of user management should we support now and in the future?

Should user authentication be implemented, and if so, how robust should it be?

What information should be immediately visible on the dashboard’s landing page?

How fast should key tasks like KYC validation be completed?

What can we integrate from existing tools to save time and resources?

Should we incorporate notifications, and how can they be implemented effectively?

Do we use an existing design system or create a custom one?

What are the limitations in backend capabilities, and how do we design around them?

How do we make the dashboard future-proof while keeping it efficient today?

Wireframing & Prototyping

This is where the magic happens. I designed user journeys, visual layouts, screens, components and interactions that balanced clarity and functionality. Every decision was guided by the goal of creating a smooth, efficient experience tailored to our team’s needs.

Design Validation

I shared early prototypes with the Operations and Development teams, incorporating their feedback into iterative improvements. These collaborative sessions helped refine workflows and address technical constraints upfront.

Handoff & Implementation

With validated designs in hand, I supported the development team during implementation, ensuring high-quality delivery and seamless integration. The iterative approach allowed us to roll out features like KYC validation first while refining others, such as user management and balance transfers.

Results

The Payaut Operations Dashboard became a game-changer for the team:

Internal dashboard built for efficiency: A central hub for managing merchant balances, accounts, KYC checks and diverse statuses.

Faster KYC Validation: Significantly reduced time required for each check

Fewer Clicks: Streamlined workflows for balance transfers, and new single-view pages that consolidate all necessary data for KYC checks, avoiding continuous back and forth between

Error-free compliance: No human errors reported since implementation.

A happier, more efficient team :)

This project underscores my passion for building tools that simplify complexity and empower the people behind the processes. I’m incredibly proud of what we achieved together! 💡